The $300M Wake-Up Call (part 2): Measuring the Gap°

A measurement framework for the gap between what you claim and what you can prove.

**TL;DR:**

Between 2023-2025, three of the highest-funded biomaterials companies pursuing ingredient branding ceased operations: Bolt Threads' Mylo, MycoWorks' facility closure, and NFW.

Using a 61-company dataset, I developed the Commercial Readiness Compass to measure the Gap° between what companies claim and what they can prove.

The 61 companies represented next-gen biomaterials at various manufacturing stages, in multiple geographic contexts, and with different and unique input types (e.g., mycelium, plant-based, cell cultivated, etc.)

The pattern is clear: companies pursuing consumer ingredient branding before operational proof experienced existential credibility collapse, regardless of funding levels.

Those maintaining tight alignment retained funding and partners even through setbacks.

Five archetypes emerged: Overstretched Flagships, Building Provers, Understated Executors, Phase-Aligned Operators, and Emerging Entrants.

The framework is actionable: companies can measure their own Gap° and adjust before credibility erodes.

Part 3 will detail the scoring methodology and introduce the Gap° Assessment Tool for companies that want to measure their own positioning, track changes over time, and receive archetype-specific strategic guidance.

-

The Commercial Readiness Compass is most valuable for:

Early-warning system for credibility risk: Identifying when visibility is outpacing verification capacity before external stakeholders lose confidence

Investor due diligence supplement: Providing a structured lens for evaluating narrative-capability alignment alongside TRL assessments and financial metrics

Strategic communication planning: Helping companies determine when to amplify visibility versus when to prioritize operational proof-building

Sector-level pattern recognition: Understanding how different go-to-market strategies (ingredient branding vs. B2B supply positioning) create distinct risk profiles

The framework should not be used as:

A standalone investment decision tool: Gap° scores complement, but do not replace, technical due diligence, market analysis, and team evaluation

A definitive failure prediction model: High Gap° indicates elevated credibility risk, not inevitable collapse

A prescriptive roadmap: The framework diagnoses misalignment but does not specify the operational changes required to close specific gaps… that requires company-specific strategic advisory

Verification Standards and Scoring Transparency

Detailed scoring methodology, verification standards, and sample company scorecards will be published in Part 3. Practitioners, investors, and researchers are encouraged to test the framework against their own datasets, propose refinements, and identify edge cases where the model performs poorly.

-

The Commercial Readiness Compass measures a company’s claimed progress versus what is verifiable. It is not a comprehensive assessment of company viability. The following limitations shape how this framework should be interpreted and applied.

Measurement Boundaries

This framework evaluates manufacturing and commercial readiness, not business model sustainability. A company can have a Gap° near zero (tight story-proof alignment) yet still face existential challenges from unit economics, supply chain brittleness, or regulatory barriers. Conversely, a company with a a larger Gap° might succeed through exceptional execution, patient capital, or market timing that this model does not capture.

Gap° is descriptive, not deterministic. The framework identifies patterns associated with credibility volatility in the cases examined, but it does not predict outcomes with certainty.

The analysis relies on publicly verifiable information. Verified Visibility (VV°) and Verified Viability (Via°) scores reflect only what can be independently confirmed through press releases, certifications, third-party reporting, regulatory filings, or partner statements. Actual operational capabilities, especially negative developments companies have not disclosed, may exceed or fall short of what is externally verifiable. Private companies operating under NDA with strategic partners may appear less capable than they are because their proof remains confidential.

Dataset and Temporal Constraints

The 61-company dataset represents quarterly snapshot assessments, not continuous longitudinal tracking. While the framework identifies correlations between Gap° widening and credibility shocks, causality remains probabilistic rather than proven.

Selection bias may be present. Understated Executors and quietly scaling B2B suppliers are structurally underrepresented in datasets derived from media coverage and press releases, potentially overstating the risks of visibility while understating the risks of obscurity.

Geographic and cultural context is under explored. The framework does not yet account for how regional capital structures, investor patience, and regulatory environments affect Gap° tolerance. A Gap° of 35° might be unsustainable for a US-based company facing quarterly VC scrutiny, but manageable for an Asian or European company with government co-investment and longer evaluation horizons.

Archetype Fluidity and Category Dynamics

Companies do not remain fixed within archetypes. A Building Prover can slide into Overstretched Flagship territory if execution velocity slows, just as an Emerging Entrant can accelerate into Phase-Aligned Operator status if proof arrives faster than anticipated. The archetypes represent current positioning at the time of assessment, not permanent classification.

The "proof types" taxonomy of technical, mechanical, and perceptual proof is provisional. Other critical validation dimensions like economic proof, supply chain proof, and regulatory proof are not yet systematically integrated into Gap° calculations. The framework currently prioritizes manufacturing readiness over business model viability, which may underweight risks that emerge post-commercialization.

A note on practicing what I preach:

Publishing Part 1 of this analysis created exactly the dynamic this framework examines: I now have an audience expecting rigorous methodology before I've published complete scoring protocols.

This is a calculated Gap°. I'm betting that the pattern recognition in Parts 1-2 is compelling enough to justify a verification delay…the same bet biomaterials companies make when early visibility buys time to deliver proof. If Part 3 doesn't provide replicable methodology, I'll have validated my own framework by failing according to its predictions.

The difference: I control my timeline. Biomaterials companies facing partner deadlines, loom scheduling, and investor quarterly reviews rarely do.

“In biomaterials, visibility becomes a navigation instrument, useful only when calibrated to an actual position.”

visibility as an operating vehicle

In most industrial innovation cycles, companies advance quietly until production reliability validates the story. Biomaterials firms rarely have that luxury. Their technologies emerge into markets that demand both technical credibility and ethical transparency, long before scale is achieved. This dynamic creates a visibility gap: a structural tension between how the story unfolds publicly and how capability matures privately.

In established deep-tech sectors, visibility tends to follow proof. Semiconductor firms, for instance, build internal credibility through yield stability before announcing process breakthroughs. Even in biotechnology, where public markets often reward early narratives, investor scrutiny remains tethered to defined trial phases. By contrast, biomaterials firms are expected to perform dual acts of transparency and persuasion from inception. They must sell a vision of environmental renewal while proving industrial competence, often with limited data, limited capital, and limited forgiveness for error.

That imbalance shapes the sector's risk profile. Visibility accelerates faster than capacity can stabilize. Announcements about partnerships, prototype launches, or new facilities generate investor confidence but also compound exposure. Every milestone becomes both proof and pressure. Within months, a communication meant to signal momentum can become a benchmark that the company struggles to meet. The story that once attracted partners becomes the yardstick against which credibility is lost.

This pattern is not unique to biomaterials, but the consequences are amplified. Textiles and consumer goods are high-touch industries; proof is both technical and sensory. Materials must not only meet tensile or yield targets, they need to feel right in the hand, drape predictably, and align with brand aesthetics and consumer expectations. When visibility outpaces readiness, reputational damage arrives faster than operational recovery. In a field where most companies are still pre-profit, visibility becomes a navigation instrument, useful only when calibrated to an actual position.

The credibility crisis in biomaterials is fundamentally about timing. When valuation depends on velocity, even small delays in proof register as breaches of trust. Visibility converts developmental lag into reputational loss; readiness gaps become liquidity risks. In a sector where investment and attention are intertwined, a temporal mismatch is indistinguishable from a credibility collapse.

Throughout this essay, credibility refers to the market's willingness to extend trust during operational friction. It is measured by a company's ability to maintain access to capital, secure new partnerships, and retain existing collaborators even when timelines slip or costs escalate. It is not simply having a good reputation; it is having enough reputational reserve that setbacks are interpreted as normal friction rather than fundamental failure. A credible company can delay a product launch and still raise funding. A company that has exhausted its credibility cannot.

To understand how this dynamic operates across the industry, I developed a framework to measure visibility risk and applied it to sixty-one biomaterials firms spanning nine input types, multiple geographies, and stages from early startup to commercial scale. What emerged was a clear pattern: companies whose public narrative remained synchronized with verifiable capability retained credibility longer, even through operational setbacks. Those whose story outpaced their science saw credibility decay faster than operational evidence could rebuild it.

The sections that follow introduce that measurement framework, map the patterns it revealed, and examine how visibility, when calibrated to proof, can function as strategic infrastructure rather than reputational liability.

the cost of proof

In practice, "proof" in biomaterials is plural:

Technical proof: whether the material performs to specifications (strength, yield, durability, etc.).

Mechanical proof: whether it survives real manufacturing conditions and can be made in large enough dimensions for practical use.

Perceptual proof: whether it satisfies sensory standards like feel, drape, and aesthetics.

These forms of validation rarely mature together. Technical proof can precede manufacturability by years; perceptual proof may arrive before either through branding or design partnerships, small sample sizes, and a well-spoken dream. This asynchrony is structural, not accidental, and it is the origin of the visibility gap.

Next-gen biomaterials are held to different standards depending on their input type. Some biomaterials must prove reliability at the level of mechanical precision. Others can validate themselves through appearance and narrative before full industrial maturity. Understanding which type a company produces determines how much visibility it can sustain without destabilizing credibility.

Textiles make this tension visible because their failure modes are immediate and obvious: threads snap, looms stop. But the same dynamic governs other biomaterial classes. Mycelium must pass drying and finishing tests without shrinking or losing important performance qualities; bio-based coatings must adhere uniformly across substrates; cultivated proteins must maintain yield stability across bioreactors. Each type has its equivalent of the loom: a process threshold where laboratory success meets industrial friction. The first proof that matters is mechanical survival under real manufacturing conditions.

By contrast, biomaterials that emulate leather or surface composites face different incentives. These materials compete on aesthetic parity (qualities like hand-feel, visual quality, and brand alignment), where minor defects can be hidden through cutting or finishing. For them, early storytelling is not just tolerated but often required to attract fashion and automotive partners. This creates a strategic trap. As Vicki von Holzhausen puts it, “It’s important because fashion is such a great vehicle for storytelling. It’s so important that we get into people’s imagination - that these materials are not just trying to copy the old, but they provide a totally different perspective.” The danger is that narrative validation could substitute for process validation, creating an illusion of readiness. When demand arrives faster than yield stability, credibility erodes.

This hierarchy of proof is familiar in other industries. Lycra and Tencel, two of the most successful ingredient brands in modern textiles, earned visibility only after reliability was proven. Lycra's decades-long refinement of stretch-fiber uniformity allowed manufacturers to integrate it seamlessly into existing equipment. Tencel's consumer recognition came later, after Lenzing had validated its closed-loop process and consistent fiber performance through industrial certification programs. Lenzing continues this proof-first discipline through their E-Branding Service, which enables traceability 'from fiber to final product,' guaranteeing authenticity before amplifying consumer visibility. Both illustrate a disciplined sequence: performance first, narrative second. Gore-Tex followed the same logic. Much of its early credibility came from institutional testing and performance contracts with the U.S. Army.

For emerging biomaterials, the cost of proof is not only financial but structural. Each product type carries its own minimum threshold of verifiable maturity before visibility can safely scale. When perceptual proof arrives before technical and mechanical proof (a.k.a., when the story becomes compelling before the material becomes reliable) visibility accelerates ahead of capability. The result is a widening gap between what the market believes the company can deliver and what the company can actually produce. Failing to meet that threshold turns publicity into volatility. Success depends on maintaining synchronization between reliability and recognition.

the commercial readiness compass

positioning the commercial readiness compass within existing frameworks

The Commercial Readiness Compass does not replace existing measurement systems but addresses a dimension they systematically overlook: the course alignment between what companies communicate and what they can verify. It addresses a gap in existing frameworks. Technology Readiness Levels (TRLs) measure capability in isolation. Gartner Hype Cycles measure sector-level visibility retrospectively. ESG scores verify sustainability claims. ROMI measures marketing efficiency. None measure the dynamic synchronization between what companies communicate and what can be publicly verified.

Together, these frameworks measure different facets of organizational maturity: technical readiness (TRL), market positioning (Gartner), sustainability verification (GRI), and marketing efficiency (ROMI). What none of them measure is the dynamic relationship between narrative and capability, or the synchronization between what a company says and what it can prove, tracked continuously as both variables evolve.

This is the gap the Commercial Readiness Compass fills. It provides a measurement system for credibility itself: the market's willingness to extend trust during operational friction, quantified as the difference between Verified Visibility and Verified Viability.

understanding the commercial readiness compass

To understand how visibility and capability interact across the biomaterials sector, I developed a framework to measure the (mis)alignment between public narrative and verifiable progress. The Commercial Readiness Compass (CRC) evaluates companies across five interdependent variables, each capturing a different dimension of how story and proof converge or diverge.

The analysis examined sixty-one biomaterials firms spanning North America, Europe, East and Southeast Asia, with additional cases in the Middle East, Latin America, and Africa. Their inputs range across nine archetypes: plant-based polymers, agricultural-waste composites, mycelium-based materials, marine-derived biopolymers, cell-cultivated proteins, recombinant spider-silk proteins, recycled synthetics, biopolymers such as PHB, and hemp-and-polymer hybrids. The companies represent a variety of ages and growth stages, from early startups founded in 2024 to established players decades old.

Each company was scored using the following variables:

Manufacturing Maturity Index (MMI)

The stage a company claims to have reached, from lab concept to full commercial production. This is self-reported capability: what the company says about itself through press releases, website copy, and public statements.

Market Signal Volume (MSV)

The quantity of public signals a company generates: press releases, partnership announcements, facility groundbreakings, media coverage, conference presentations, and social media activity. MSV measures how loudly a company communicates, regardless of substance.

Verified Visibility (VV°)

The share of public signals (MSV) independently corroborated through partners, registries, certifications, third-party reporting, or market evidence. VV° distinguishes between claims and confirmations. A partnership announcement that appears only on the startup's blog scores lower than one confirmed by the partner or covered by independent trade press. VV° measures credible attention: the portion of visibility backed by external validation.

Verified Viability (Via°)

The level of production capability proven through verifiable criteria: facility commissioning, certified capacity, audited output, regulatory approvals, peer-reviewed data, or documented integration into a partner's supply chain. Via° measures operational reality: what the company can demonstrably do, independent of what it says it can do.

Gap°

The angular difference between Verified Visibility (VV°) and Verified Viability (Via°), measuring the misalignment between market expectations and operational capability.

Positive Gap° (VV° > Via°): The company's story is ahead of its proof. Market expectations exceed confirmed capability.

Negative Gap° (Via° > VV°): The company's proof is ahead of its story. Operational capability exceeds public recognition.

Near-zero Gap° (±5°): Story and proof are tightly synchronized.

“Gap° functions as an early-warning system. When the distance between story and proof exceeds a company’s ability to deliver verifying evidence within a reasonable timeframe, credibility begins to erode.”

The Instability Threshold

Across the dataset, large positive Gaps° often preceded credibility shocks: delayed partnerships, funding pauses, production halts, or quiet retractions. For instance, Bolt Threads' 2023 suspension of its Mylo program followed more than a year of elevated visibility relative to confirmed production data. The company's announcements about partnerships and material availability outpaced verifiable evidence of manufacturing scale, creating a widening positive Gap°.

Conversely, companies maintaining tight Gap° alignment retained stakeholder confidence even through operational setbacks. Ecovative Design navigated multiple pivots, from packaging to building materials to leather alternatives, without credibility collapse because each shift was grounded in demonstrated manufacturing capability. When the company announced Forager leather alternatives in 2020, it did so after years of proven mycelium composites production for IKEA and Dell, not before.

Similarly, Spiber endured cost overruns and financing delays while maintaining partner confidence, though its Japanese capital structure (patient capital, government co-investment) provided more runway than most US/EU competitors could access. The pattern across both cases suggests that credibility is not simply about avoiding problems. It's about maintaining enough course alignment that problems are interpreted as friction rather than failure.

Gap° functions as an early-warning system. When the distance between story and proof exceeds a company's ability to deliver verifying evidence within a reasonable timeframe, credibility begins to erode. The market tolerates some misalignment, companies are expected to project forward momentum…but when that projection becomes structurally unsustainable, the correction is swift and punishing.

The following sections present insights derived from applying this framework to examine how different strategies can be applied to manage the Gap° over time.

Reading the Commercial Readiness Compass

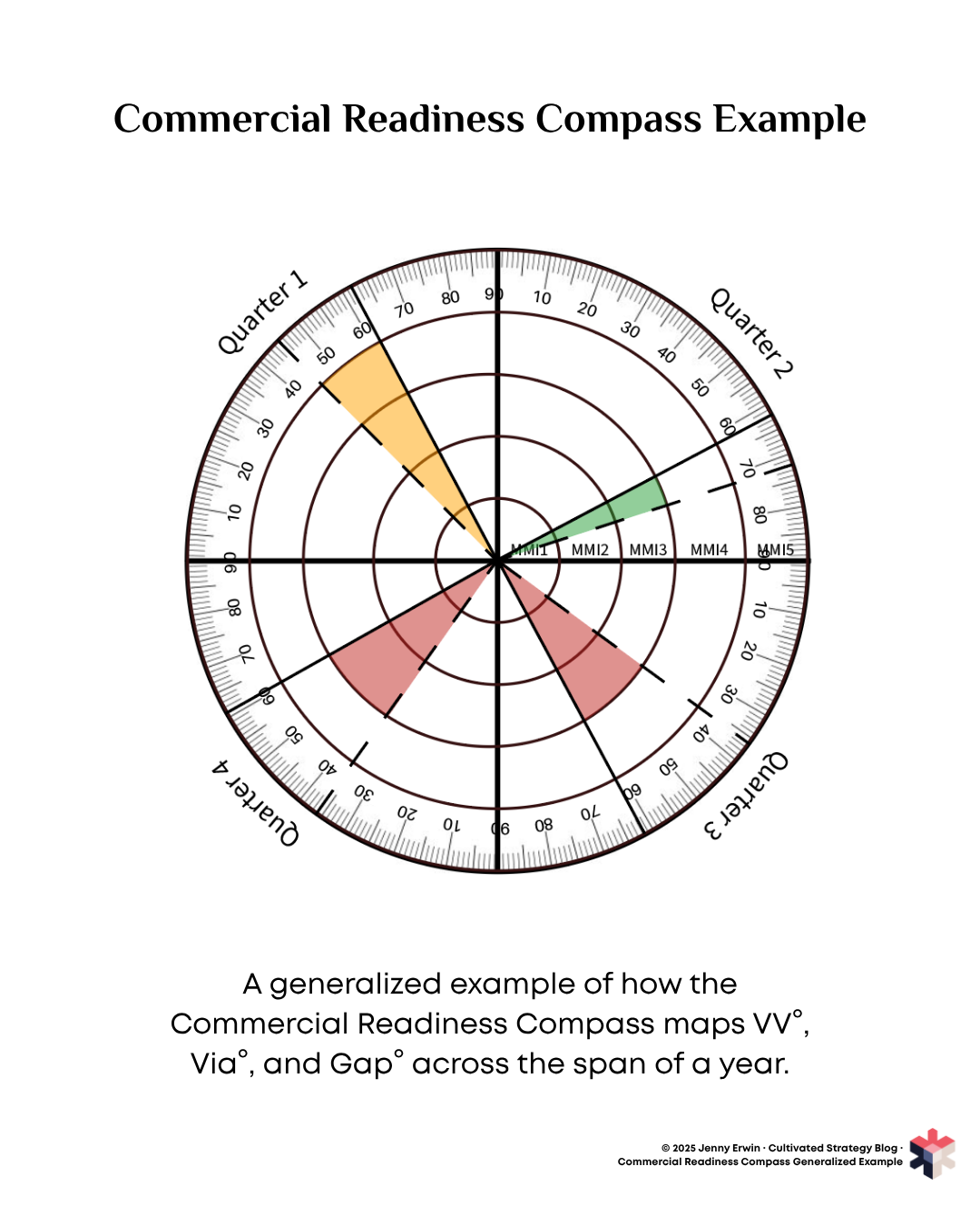

The Commercial Readiness Compass visualizes how these variables interact over time. The compass is organized as follows:

Radial axis (MMI): Manufacturing Maturity Index extends outward from the center, with MMI1 (lab concept) at the center and MMI5 (full commercial production) at the outer edge. This shows the company's claimed stage of development.

Angular axis (degrees): The circle is divided into quarters, typically representing time periods (e.g., quarterly reporting periods). As time progresses, data points move clockwise around the compass.

Verified Visibility (VV°): Plotted as a solid black line.

Verified Viability (Via°): Plotted as a dashed black line.

Gap°: The distance between VV° and Via°. When VV° appears ahead (clockwise) of Via°, the Gap° is positive: the story is running ahead of proof. When Via° appears ahead of VV°, the Gap° is negative: proof is accumulating faster than public recognition.

In the generalized example above, three patterns are visible:

Quarter 1: VV° sits ahead of Via°, creating a positive Gap°. This company is generating visibility while operational capability lags behind. The company is in the MMI4 stage operationally.

Quarter 2: Via° is ahead of VV°, showing tight alignment. However, the company has dropped down to MMI3, indicating an event triggering a lower claim for production capacity.

Quarters 3-4: VV° has moved ahead of Via°, and the gap has widened into a “danger zone”, all while maintaining MMI3. Operational capability has stalled while public narrative continues to advance. This is a likely time for stakeholders to lose confidence.

Part 3 will introduce assessment tools for companies that want to measure their own Gap° and track positioning over time. For now, the framework serves as a diagnostic lens for understanding credibility dynamics across the sector.

patterns of visibility

In biomaterials, two dominant go-to-market strategies determine how visibility behaves: ingredient branding and B2B supply. Ingredient branding requires early public signaling to attract design and retail partners. B2B supply relies on industrial validation and tends to delay communication until production reliability is proven. These are not stylistic choices but structural necessities: each depends on convincing a different audience first.

In early-stage industries, visibility serves three interdependent functions: it attracts capital, validates market demand, and signals operational progress. Misalignment among these signals can be costly: when communication races ahead of capability, scrutiny intensifies; when it lags behind, opportunity slips from view.

The same visibility-readiness tensions visible in biomaterials also appeared in alternative proteins, where Beyond Meat and Impossible Foods secured massive early visibility before unit economics stabilized (detailed in the Category Creation Paradox below).

Engineers may validate tensile strength and yield consistency, but that proof alone doesn't guarantee manufacturability. A fiber that performs flawlessly in the lab can still fail in production by shedding, fraying, or stiffening when exposed to the heat and tension of industrial looms. Only once it survives that mechanical scrutiny can designers evaluate drape, surface feel, and visual finish. Mycelium-based composites face similar hurdles: a sheet may meet strength targets yet warp, crack, or discolor during drying and finishing. In practice, technical, mechanical, and sensory proofs evolve on different clocks, and visibility sits between them, often accelerating before all three align.

This dynamic creates predictably different Gap° profiles depending on go-to-market strategy. Ingredient-branded firms tend to generate high VV° early since their partnerships with fashion houses and automotive brands amplify public attention, while Via° matures more slowly behind the scenes. B2B suppliers face the opposite challenge: they build Via° through industrial partnerships and certifications but struggle to convert that progress into public recognition, resulting in low VV° even as capability advances.

The Capital Disparity

This strategic divergence has measurable financial consequences. In the data set, ingredient-branded firms that focused on mycelium and plant-based inputs secured 3.7 times the average total capital per company compared to B2B peers. Materials that consumers can immediately visualize attract disproportionate funding, even when technical readiness lags. (A consumer understands what an apple or a mushroom is and can picture it… most can’t picture cultivated cells.) That excess capital brings visibility obligations: investor updates, partner showcases, conference cycles designed to validate momentum. Each financing event reinforces the expectation that the story will advance, regardless of whether manufacturing proof has caught up. B2B firms raise less but avoid that escalation, accepting longer sales cycles and tighter budgets in exchange for reduced credibility risk.

Two Strategies, Two Risks

Based on the comparative analysis of sixty-one biomaterials firms across inputs and markets, a consistent pattern emerged: those aligning visibility with operational milestones retain credibility longer, even through setbacks. Companies that let VV° run persistently ahead of Via° saw credibility decay faster than operational recovery could rebuild it, regardless of how technically sophisticated their materials were.

The challenge for biomaterials firms is not whether to tell their story, but how to keep that story in phase with what the world can actually verify. The sections that follow examine five distinct archetypes that emerged from the data, with each representing a different approach to managing the Gap° between story and proof.

the spectrum of branding strategies

The data revealed five recurring archetypes, each representing a different approach to managing the relationship between visibility and proof. But these aren't just communication patterns, they're also branding strategy choices. Each archetype reflects a different answer to the fundamental question: When should we make our material visible to consumers?

Two dominant branding approaches shape how visibility behaves:

Consumer ingredient branding: Build end-customer recognition through hangtags, campaigns, and brand partnerships. This requires early public signaling to attract design and retail partners, creating consumer pull that influences purchasing decisions. High visibility, high risk.

B2B platform/supply branding: Build trust with manufacturers through specs, certifications, and supply-chain reliability. The brand shows up in material specs and preferred-supplier status, not on consumer-facing hangtags. Low visibility, lower risk…but also limited pricing power and slower market penetration.

The five archetypes represent different executions of these strategies, from aggressive consumer branding before operational proof (highest risk) to deliberate B2B positioning with deferred consumer recognition (lowest risk). They describe strategic postures, not permanent identities. Companies can transition between them as their manufacturing maturity or branding strategy evolves.

“All three secured major luxury partnerships. All three deployed consumer-facing ingredient brands. All three raised substantial capital. All three failed when production could not meet the expectations their visibility created.”

Archetype 1: Overstretched Flagships

Branding Strategy: Consumer ingredient branding deployed before operational proof

Pattern: Narrative velocity exceeding process reliability.

The Pattern Confirmed:

Between 2023 and 2025, three of the sector's highest-funded companies pursuing this strategy ceased operations or paused production on their ingredient branded material:

Bolt Threads / Mylo: $300M+ raised, partnerships with Kering, Stella McCartney, Adidas, Lululemon → Mylo production paused 2023

MycoWorks / Reishi: $187M+ raised, Hermès partnership, MoMA installations → South Carolina facility closed October 2025, pivoting to Rei-Tan™ processing technology, Reishi production paused (could represent an archetype transition - time will tell)

Natural Fiber Welding / Mirum: $145M raised, partnerships with Allbirds and Camper, launched platform of four branded materials (Mirum, Clarus, Pliant, Tunera) → Company closed October 2025

All three secured major luxury partnerships. All three deployed consumer-facing ingredient brands with registered trademarks. All three raised substantial capital. All three failed when production could not meet the expectations their visibility created.

The Category Creation Paradox

The Overstretched Flagship archetype presents a strategic paradox: the same visibility that creates systemic instability can also create entire market categories. Before dismissing this approach as simply reckless, it's worth examining when aggressive overexposure becomes rational, even necessary.

Beyond Meat and Impossible Foods exemplify this tension. Both companies deployed massive visibility campaigns long before their unit economics stabilized. Beyond Meat's 2019 IPO came with extraordinary retail expansion and cultural cachet, yet production efficiency lagged, facility utilization remained uneven, raw-material costs stayed high, and gross margins turned negative by 2023. Impossible Foods pursued a comparable trajectory: high-profile partnerships and aggressive marketing built early traction, yet profitability remained elusive, forcing the company to postpone its IPO when it became clear investor expectations had outpaced manufacturing readiness. As CEO Peter McGuinness course corrected, “I don't want to be pigeonholed into an IPO”.

By conventional Gap° analysis, both should be classified as failures. Yet both achieved something more fundamental: they made plant-based meat a mainstream category. Before Beyond and Impossible, plant-based proteins occupied a niche health-food aisle. After their visibility blitz, they secured permanent shelf space at major retailers, normalized the category in consumer consciousness, and created the market infrastructure that later entrants now inherit.

Why Biomaterials Couldn't Replicate Alt-Protein Success

The critical difference lies in proof architecture. Alt-proteins required two forms of validation: taste (sensory proof) and availability (distribution proof). Both are relatively controllable. A company can optimize formulation in controlled food-science labs, then secure retail partnerships. The product's performance is binary: consumers either like the taste or they don't, and retailers either stock it or they don't.

Biomaterials require three interdependent forms of proof: technical, mechanical, and perceptual. They mature on different timelines and depend on external manufacturing infrastructure the startup doesn't control. A material can pass lab testing (technical proof) yet fail on industrial looms (mechanical proof). It can achieve mechanical proof yet fail to meet brand aesthetic standards (perceptual proof). And crucially, proving mechanical reliability requires access to manufacturing partners whose equipment, tolerances, and production schedules the startup cannot dictate.

This structural difference means biomaterials cannot "fake it till they make it" the way consumer packaged goods can. Beyond Meat could reformulate its product in months and restock shelves. A biomaterials company wouldn’t be able to do the same without years of materials science iteration.

When Strategic Overexposure Works:

Aggressive overexposure appears strategically rational only when these conditions align:

The company controls the full value chain from production through distribution

Proof of concept is rapid and binary (tastes good/bad, works/doesn't work)

The category doesn't yet exist in consumer consciousness, making visibility itself valuable even if specific companies fail

Capital markets reward category creation independent of unit economics

Key Insight: The Overstretched Flagship archetype is a high-risk category creation strategy that works when proof is controllable and rapid. For biomaterials, where mechanical proof cannot be accelerated by marketing timelines, this strategy converts the manufacturing dependency problem into an existential credibility crisis.

Risk: When visibility dramatically outpaces proof across multiple quarters while mechanical proof remains unverified, credibility erodes faster than operational pivots can rebuild it. Three collapses in three years prove the pattern: ingredient branding without operational proof is structurally unsustainable for biomaterials.

Archetype 2: Building Provers

Branding Strategy: Consumer ingredient branding with active visibility/proof management

Pattern: Linking narrative to tangible proof points.

Profile: Building Provers pursue ingredient branding but with operational discipline. They are in a high-stakes zone: visibility is ahead of proof, but not yet dangerously so.

Examples:

Polybion / Celium: demonstrates disciplined ingredient branding through design collaborations. Rather than announcing massive fashion partnerships prematurely, Polybion builds brand through controlled design projects: the Lapso lamp (unveiled at London Design Festival 2025, collaboration with Natural Urbano) and Ganni partnership. Each project demonstrates material capabilities in real applications while the company scales production infrastructure. The messaging emphasizes "impact requires scale", acknowledging that visibility without production capacity is unsustainable.

Biophilica / Treekind: pursues consumer ingredient branding but grounds visibility in verifiable proof. The company's website prominently features ISO testing results, published LCA data, and specific performance metrics. Treekind is a registered trademark positioned for consumer applications (watch straps, accessories, small leather goods), but the company leads with certification and testing rather than aspirational claims. This is an ingredient branding strategy blended with a credibility building phase.

Tandem Repeat / Squitex: represents the highest-risk variation of this archetype: launching their own fashion brand (not just supplying material). The company plans a capsule collection launch while scaling production from 500kg to 1,000 metric tons (supported by $1.5M DoD grant). Tandem controls both the material brand and the consumer brand. This vertical integration provides more control over narrative timing but also concentrates all risk: if the material underperforms, the entire brand fails.

Modern Meadow / Innovera: pursues a dual-tier strategy: Mercedes-Benz partnership (luxury validation) + Bellroy partnership (volume and proof of scalability). This approach addresses the core tension: luxury partnerships generate visibility and credibility, while accessible consumer goods partnerships prove the material can deliver at commercial scale.

Key Insight: Building Provers operate in the tension zone. They've generated enough visibility to attract capital and partners, but they haven't yet caught their proof up with their visibility. Success depends on execution velocity, proving the material works before market patience expires.

Risk: If proof doesn't advance quickly enough to meet visibility, these companies slide toward the Overstretched Flagship category. The difference between Building Provers and Overstretched Flagships is tempo: can you deliver proof faster than expectations compound?

Archetype 3: Understated Executors

Branding Strategy: B2B platform/supply positioning with no consumer ingredient brand

Pattern: Proof leads, story follows.

Profile: Understated Executors build operational capability faster than they communicate about it, prioritizing long-term supply-chain trust over short-term media visibility. This restraint is a powerful B2B signaling mechanism: in a market saturated with over-promising, operational discipline becomes the differentiator.

Examples:

Ecovative Design: exemplifies this approach. The mycelium company operated for years primarily on USDA and EPA grants, strategic manufacturing partnerships, and licensing revenue before raising significant venture capital. This funding structure allowed the company to build credibility reserves through pilot production facilities and manufacturing partnerships while maintaining modest public visibility.

Unlike mycelium-leather competitors that raised large VC rounds early and faced immediate pressure to announce partnerships and timelines, Ecovative's funding model meant it could pace early communication to verified milestones. The company's visibility grew organically through customer adoption and trade press coverage.

AMSilk: demonstrates how B2B technical positioning insulates against credibility volatility. With less than one-third of the funding NFW/Mirum raised before closure, AMSilk survived by positioning its biotech silk yarns as industrial inputs, “industry standard" fibers compatible with existing textile machines, rather than consumer ingredient brands.

The company's website emphasizes technical performance ("AI-driven protein engineering," "precision biofermentation," "customization at molecular level") over sustainability storytelling. Partnerships with Mercedes, Airbus, and OMEGA function as B2B validation, not consumer campaigns. These partnerships prove manufacturing reliability and supply-chain integration without creating consumer expectations the company cannot meet.

Key Insight: Additional proof functions as navigational reserve, allowing companies to absorb unexpected visibility without destabilizing. When fashion houses or automotive brands amplify visibility suddenly, the company can absorb that attention by drawing upon accumulated proof reserves.

Risk: Prolonged silence can limit awareness in markets that reward visibility as validation. B2B firms raise less capital (73% lower average funding rounds than ingredient-branded peers in the 61-company data set), face longer sales cycles, and may struggle to recruit talent in a sector where consumer-facing brands dominate headlines.

Archetype 4: Phase-Aligned Operators

Branding Strategy: Staged approach…prove B2B reliability first, then selectively deploy ingredient branding

Pattern: Deliberate synchronization of communication tempo with verifiable readiness.

Profile: Phase-Aligned Operators demonstrate what strategic discipline looks like in practice. Their strategy reflects careful correlation between narrative timing and technical milestones. These companies recognize that ingredient branding may be valuable eventually, but they refuse to deploy it prematurely. They build B2B proof first, then decide whether consumer visibility is strategically necessary.

Examples:

Spiber operates with patient capital that tolerates proof-first timelines. They emphasize production capability, scaling, partnerships, and large-scale financing tied to manufacturing. This strategic discipline allowed Spiber to sustain momentum through financial turbulence: when the company faced cost overruns and financing deficit for R&D, it retained partner confidence because its narrative had never outpaced its capability.

Spiber's partnerships with Goldwin (The North Face Japan) function as B2B validation before consumer campaigns. The company strategically uses ingredient branding with Brewed Protein, but uses it more as a B2B quality determinant rather than a consumer facing ingredient brand.

Faircraft pursues "scale quietly, launch late" strategy despite securing luxury testing partnerships with Balenciaga, Loewe, and Stella McCartney. They emphasize B2B messaging ("fine tune our materials to help you bring the right emotions to life, at the cellular level") rather than consumer campaigns.

The cell-cultivated leather positioning solves the Aesthetic Paradox through process-as-brand: "Real leather, grown in a lab from cow cells" differentiates even though the end material looks identical to traditional leather. Faircraft is building the story (process narrative) while proving operational capability (luxury partner validation). The company may deploy ingredient branding once unit economics stabilize, but seems to refuse to rush visibility for fundraising purposes.

Key Insight: Phase-Aligned Operators treat visibility as proof confirmation, not proof substitution. They allow operational milestones to set the tempo of communication. When setbacks occur, the market interprets them as friction rather than failure because the company has built trust through consistent alignment. Gap° stability signals organizational coherence: the leadership team controls both the narrative and the timeline.

Risk: Minimal, relative to other archetypes. The primary vulnerability is external shock (macroeconomic downturn, regulatory change, partner bankruptcy) rather than self-inflicted credibility collapse. The tradeoff is delayed brand recognition: competitors pursuing aggressive ingredient branding may capture mindshare and potential partnerships first, potentially limiting pricing power later.

Archetype 5: Emerging Entrants

Branding Strategy: Deferred decision. They operate quietly, build proof, determine branding approach later.

Pattern: Proof-first mandate from day one. Operating at pilot scale while grounding all visibility in verifiable evidence.

Profile: These companies treat communication as alignment, not amplification, releasing modest but coherent signals where every claim corresponds to reproducible results.

Rather than committing to ingredient branding or B2B positioning prematurely, Emerging Entrants focus on proving the material works first. The branding decision comes later, once they understand their material's competitive positioning, manufacturing economics, and market dynamics.

Examples:

Kintra Fibers illustrates this archetype clearly. The company develops a biodegradable and compostable form of polyester, and has grounded its visibility in measurable progress. Its announcements center on pilot-scale trials and technical validations such as yarn development with Pangaia and Fashion for Good’s support of their work with brand partners BESTSELLER, Inditex, Reformation and manufacturing partner Paradise Textiles.

The Strategic Advantage of Waiting:

By deferring the branding decision, Emerging Entrants avoid premature commitments that constrain options later. If the material achieves performance breakthrough, ingredient branding becomes viable. If unit economics favor industrial applications, B2B positioning makes more sense. If manufacturing proves more volatile than expected, staying invisible preserves credibility.

This low-amplitude strategy inoculates Emerging Entrants against the instability seen in earlier, highly-funded entrants. They accept slower capital accumulation and longer partnership cycles in exchange for durable credibility. Their visibility values are modest but coherent, building recognition incrementally rather than explosively.

Key Insight: Credibility is easier to build than rebuild. Emerging Entrants prioritize foundation over fanfare, recognizing that early restraint creates late-stage resilience and preserves strategic flexibility to choose the optimal branding approach once operational reality becomes clear.

Risk: Capital constraints. Investors often reward visibility with funding, and companies that remain too quiet may struggle to raise sufficient capital to reach commercial scale.

The Common Thread

Across these archetypes, visibility doesn't create instability, it accelerates whatever dynamics already exist. When calibrated to the pace of verification, it compounds resilience. When it drifts ahead, it converts uncertainty into volatility. The challenge for biomaterials firms is not whether to build a brand, but when to make that brand visible to consumers, and whether consumer visibility is strategically necessary at all.

“In a market saturated with over-promising, operational discipline becomes the differentiator.”

managing the gap° as strategy

The Commercial Readiness Compass measures the discrepancy between where a company appears to be and where it actually is. Gap° is an important result of that measurement. It represents the distance between Verified Visibility (VV°) and Verified Viability (Via°), or the proportion of Market Signal Volume which is verifiably true, and the proportion of claimed operational stage (MMI) which is confirmed compared to what a company claims.

Positive Gap° (VV° > Via°): The company's story is ahead of its proof. Market expectations exceed confirmed capability. This is where credibility risk lives.

Negative Gap° (Via° > VV°): The company's proof is ahead of its story. Operational capability exceeds public recognition. This creates navigational reserves that absorb unexpected visibility.

Near-zero Gap° (±5°): Story and proof are tightly synchronized.

The data reveals that the companies which survived weren't necessarily smarter, better-funded, or more technically sophisticated than those that struggled, pivoted, or collapsed. The difference was synchronization, the ability to keep the tempo of communication aligned with the pace of verification.

But that alignment is not equally accessible to all companies. The sector's funding dynamics, partnership structures, and material categories create structural pressures that make some companies more vulnerable to Gap° instability than others.

The Material Category Problem

Not all biomaterials face the same Gap° pressures. The data reveals a clear pattern: materials that are easy to narrate attract disproportionate funding and visibility, regardless of technical maturity.

Mycelium and plant-based leather alternatives secured 3.7x more capital because investors can immediately visualize the end product based on their familiarity with the basic input type. The material also looks familiar to consumers, making the story compelling even when the science is immature. By contrast, biopolymer fibers, cultivated proteins, and fermentation-derived materials require technical literacy to appreciate. They don't photograph well. They feel abstract to the average person, or even designer. As a result, they attract less capital and generate less visibility, which paradoxically may protect them from premature credibility collapse.

AMSilk's biotech silk yarns and Ecovative's mycelium composites operate in categories where consumer recognition is not required for commercial success. They sell to manufacturers who evaluate materials through technical specifications, not brand narratives. This insulates them from the visibility-readiness gap that claimed pure consumer-facing ingredient brands.

In biomaterials, narrative-rich materials (those consumers can easily visualize) attract excess capital and visibility before operational proof can sustain it. Narrative-poor materials (technical, industrial inputs) grow more slowly but appear to have structural protection from credibility volatility.

“The power is in reduction to one memorable phrase that consumers can repeat and verify.”

The Aesthetic Paradox in ingredient branding

When bio-leather successfully mimics traditional leather, it erases the visual cues ingredient branding requires. The material looks identical…so how do you build brand recognition?

Product-as-Story:

Polybion does this well by poetically describing biological variability as “unique and distinct as a fingerprint”. This human-first positioning is emotionally charged language similar to Tencel’s “Nature. Future. Us.” This strategy works because it makes the invisible tangible and relatable. Consumers can't see sustainability metrics or carbon footprints, but they can understand “unique like me” messaging.

Performance-as-Story:

When aesthetics are identical, verifiable performance advantages become the brand story. Gore-Tex pioneered this for materials that looked indistinguishable from competitors: the fabric appeared ordinary, but "guaranteed to keep you dry" became a testable, memorable brand promise that excels in its simplicity. It almost feels like a call to action - can the material keep you dry? The power is in reduction to one memorable phrase that consumers can repeat and verify. For biomaterials pursuing aesthetic parity with traditional materials, this means identifying one defensible performance claim that can be compressed into a simple and memorable phrase (not "achieves 95% tensile strength retention over 10,000 flex cycles per ASTM D5034").

Provenance-as-brand:

Biological materials have production rhythms that can create narrative identity. Rather than treating growth cycles as manufacturing constraints, companies could position batches temporally and environmentally. This mirrors the dual logic of wine: terroir defines place identity, while vintage defines time identity. For example, Domaine Drouhin describes their estate as, “Poised atop the Dundee Hills, with gentle slopes that capture the breezes and sunshine, our 235-acre estate overlooking the Willamette Valley produces some of the finest Pinot Noir and Chardonnay fruit in the world.” Depending on input type, each production cycle has unique characteristics based on input variability, ambient conditions, and growth parameters. Why not embrace that? Batch-specific identity transforms biological variability from a quality control challenge into a premium positioning tool: consumers aren't buying generic "bacterial cellulose leather alternative," they're buying "the batch grown during specific conditions that won't be exactly replicated."

In biomaterials, ingredient branding requires narrative infrastructure that substitutes for the visual differentiation traditional ingredient brands relied on. Companies without compelling stories will struggle to sustain consumer-facing visibility.

conclusion and looking forward

Visibility in biomaterials is an amplifier that reflects, magnifies, or destabilizes the underlying cadence of proof. Branding functions as the public representation of capability. Visibility is a capital conduit, a partner acquisition tool, and (when misaligned) a liability that accelerates whatever dynamics already exist.

This sector is uniquely exposed because its proofs are plural. Technical, mechanical, and perceptual validations mature on different timelines, and most companies rely on external manufacturing infrastructure they cannot directly control. That structural asynchrony means visibility must be managed as a risk factor, not a PR opportunity. When narrative-rich materials attract disproportionate attention before mechanical reliability stabilizes, the Gap° widens. And once expectations outrun what the world can verify, credibility can erode faster than operational evidence can rebuild it.

The archetypes that emerged from the 61-company dataset (Flagships, Provers, Executors, Phase-Aligned Operators, and Entrants) are not personality types. They are structural responses to the pressures that visibility exerts on verification. Their outcomes make one truth unmistakable: the future belongs to companies that treat visibility as an operating variable. In this sector, communications discipline is as essential as yield stability or cost of goods. Managing Gap° should sit alongside burn rate and capacity utilization as a boardroom metric, an explicit measure of whether the story and the system are moving in phase.

What comes next is not about reducing visibility but recalibrating it. The companies that endure will be those that build enough credibility reserve to absorb friction, pace their narrative to the tempo of manufacturing proof, and resist the gravitational pull of premature consumer branding. Biomaterials will not overcome its volatility through larger rounds, louder stories, or faster cycles of partnership announcements. It will stabilize through synchronization: visibility calibrated to verifiable capability, narrative aligned with production readiness, and branding deployed only when operational maturity can sustain it.

The path forward is clear: credibility is not earned by being perfect, it is earned by being predictable. And the next generation of biomaterials companies will succeed by mastering the discipline that this sector now demands: keeping story and proof in strategic, measurable, and unwavering alignment.

About the Author

Jenny Erwin is a strategic marketing consultant specializing in sustainable materials and luxury brand positioning. Her master's thesis explored go-to-market strategies for cell-cultured leather in the equestrian luxury saddle market, including primary consumer research with 139 equestrians, and comprehensive competitive analysis of biomaterial technologies. She holds a BFA in Advertising and an MA in Luxury and Brand Marketing (Summa Cum Laude) from SCAD, and previously founded sustainable fashion brand Apacceli, which launched at the 2018 World Equestrian Games, showed collections at New York and Paris Fashion Weeks, and was invited to collaborate with Macy’s on a 2019 collection for their Market at Macy’s initiative. Jenny is currently exploring opportunities in strategic marketing and commercialization for next-generation materials. Click here to connect on LinkedIn.