Comprehensive market research and go-to-market strategy for introducing cell-cultured leather into a traditional, performance-critical industry.

From Hide to Hybrid: How Lab-Grown Leather Could Redefine Equestrian Luxury

Master's Thesis | Strategic Marketing Research & Planning | 2020-2022

The Opportunity

The bio-based leather alternatives industry has experienced significant growth over the past five years, publicly driven largely by luxury fashion brands seeking cruelty-free material options. Hermès launched a mycelium-based handbag in 2021, and Stella McCartney has built her brand around animal-free materials. However, the equestrian industry (despite its close historical relationship with fashion) has not adopted bio-based leather alternatives for performance equipment like saddles.

The equestrian industry presents unique challenges for material innovation. The sport is steeped in tradition, performance requirements are non-negotiable (rider safety and horse comfort depend on equipment quality), and previous attempts to introduce synthetic saddles created a lasting stigma around "fake leather" being inferior quality. The research question at the center of this project was: Could a bio-based leather alternative succeed in an application where plastic-based synthetics had failed?

what i did

I approached the question from both sides: the innovation pipeline shaping bio-based leathers and the entrenched ecosystem of the equestrian equipment market.

Industry Research

Analyzed market growth, investment patterns, and technological development across next-gen materials, from synthetic PU-based leathers to cell-cultured and mycelium innovations.

Conducted comparative strategic case studies on leading bio-material technologies (including mycelium-based, microbial, and cell-cultured) to assess which offered the highest material fidelity and performance pathway required for luxury equestrian equipment, resulting in the selection of VitroLabs for the final go-to-market proposal.

Tracked macro trends: consumer demand for sustainability, investor movement toward “next-gen” materials, and fashion’s early adoption as proof of concept.

Market Research

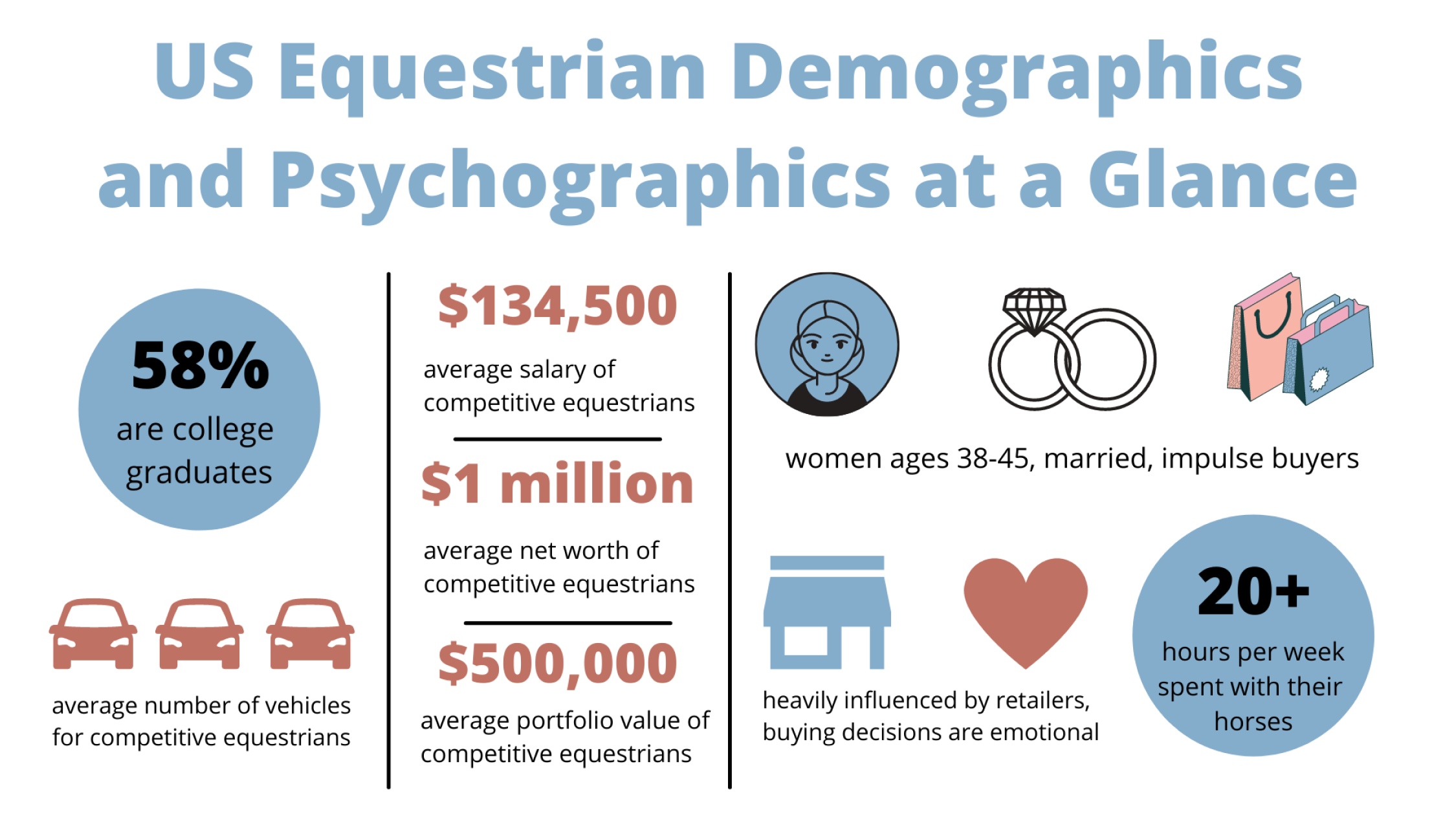

Investigated the global equestrian equipment market (valued at $1.9B), with saddles representing roughly 30% of total sales.

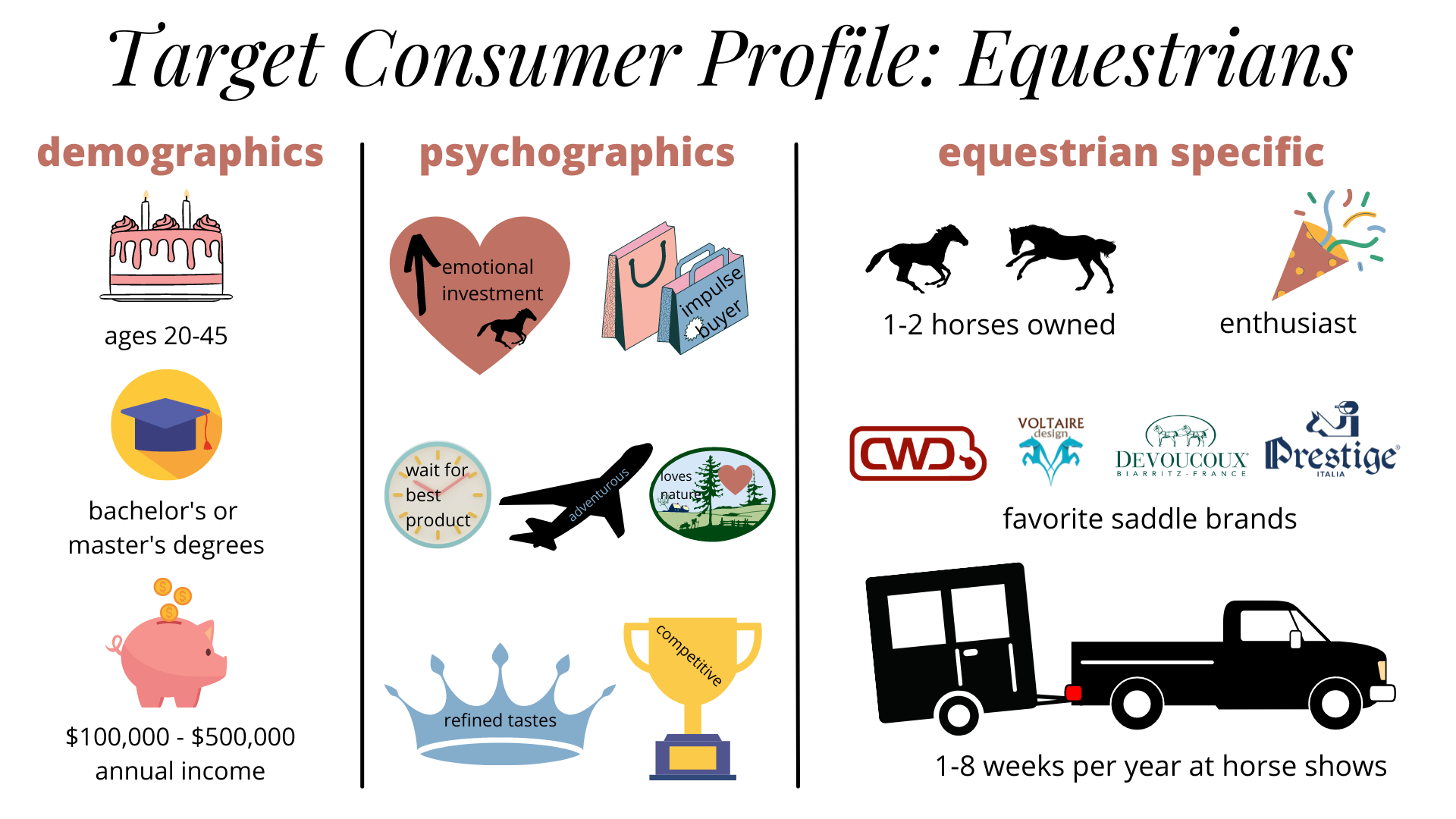

Conducted a consumer survey of 139 equestrians, capturing demographics, purchase behavior, price sensitivity, and perceptions of alternative materials.

Identified a 55% openness to purchasing a saddle made from bio-leather paired with skepticism around durability, longevity, and “feel.”

Key Finding: Interest was conditional. Riders were intrigued by sustainability, but unwilling to sacrifice performance. The material had to match or outperform traditional leather in every measurable way.

the outcome

Based on these findings, I developed a strategic business case proposing an exclusive sourcing partnership between VitroLabs, Inc. (a cell-cultured leather biotech company) and Prestige Italia (a luxury Italian saddle manufacturer known for technical innovation).

The proposal included:

Market Positioning: Launching through the luxury segment first to establish performance credibility and aspirational appeal.

Product Concept: A “Genesis” saddle design showcasing material parity with traditional leather and a cleaner environmental profile.

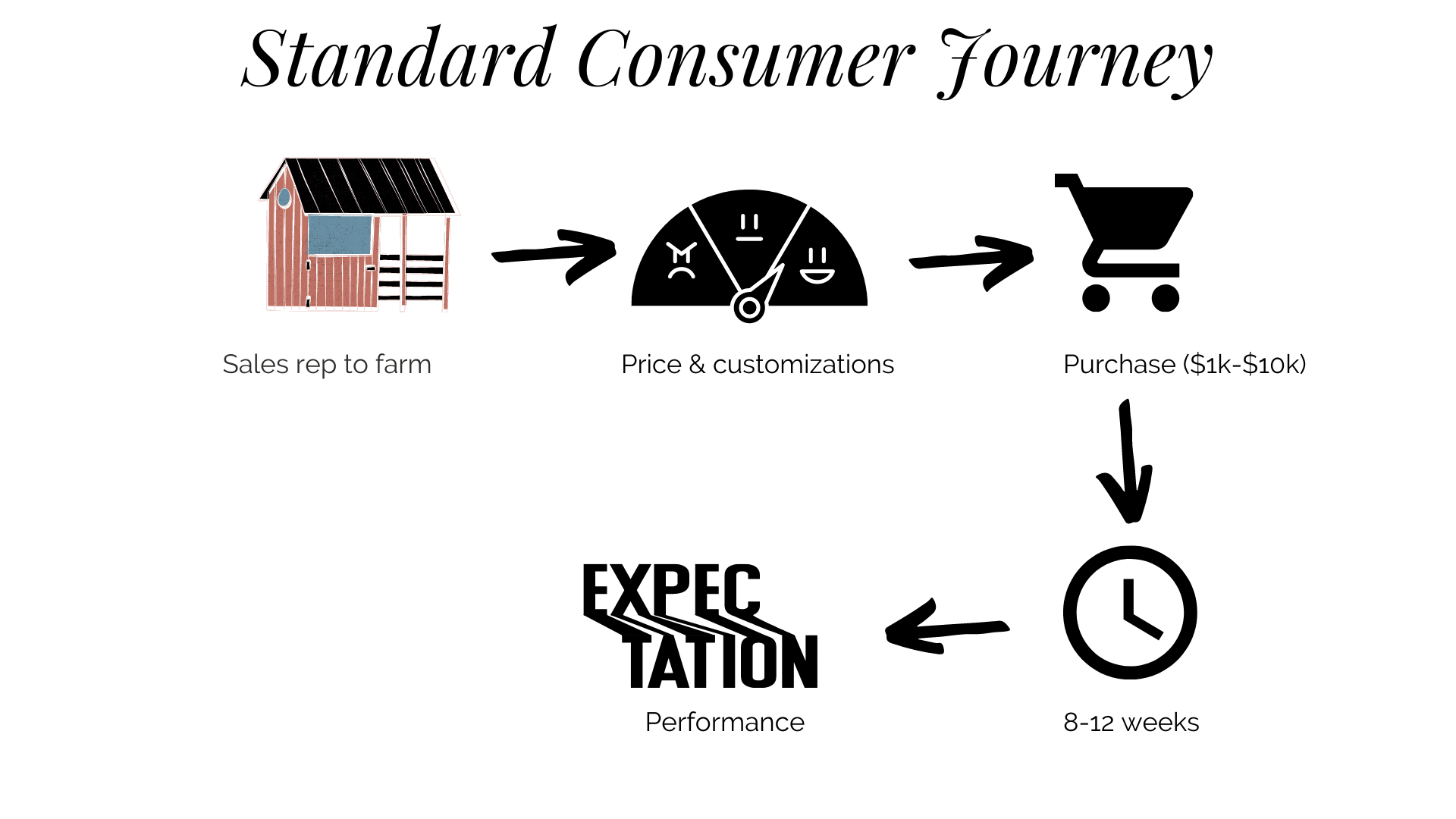

Sales Strategy: Combining Prestige’s direct sales model (farm visits, fittings, show circuits) with targeted digital channels and a custom app addressing consumer pain points.

Go-to-Market Plan: 13-month phased rollout, pre-launch partnerships, and Grand Prix sponsorship integration.

Financials: Investment breakdown ($485,916), breakeven analysis (115 units), and three demand scenarios.

The result was a detailed roadmap for how cell-cultured leather could enter and ultimately redefine one of the most traditional luxury markets in existence.

why the equestrian industry?

-

The equestrian industry represents a fascinating paradox: it's both intimately connected to fashion and frustratingly resistant to change. It sits at an intersection of luxury, tradition, and performance, an industry that prizes craftsmanship, heritage, and technical precision, but one also built on an emotional connection to animals. That duality makes it uniquely positioned to lead a meaningful shift toward ethical innovation.

-

The two industries have always informed one another stylistically, materially, and philosophically. Brands like Hermès built their luxury empires on equestrian heritage, literally beginning as a harness maker. Coco Chanel designed the first women's riding pants, redefining fashion. Finally, fashion's history has already proven that "heritage" and "progress" aren't mutually exclusive.

-

Yet while fashion houses were experimenting with mycelium, bio-based, and cell-cultured leathers and launching vegan collections, the equestrian equipment market remained locked in tradition. As equestrian apparel adapts to athletic wear trends, it's only a matter of time before the same evolution reaches tack and equipment.

-

This disconnect created a white space opportunity. If bio-based leather alternatives could succeed anywhere beyond fashion, it would need to be in a market where performance requirements are absolute (proving the material works under demanding conditions), consumer values are shifting (creating demand beyond pure functionality), and the right brand partnership could overcome category skepticism (leveraging heritage to validate innovation).

The equestrian saddle market checked all three boxes. Lab-grown leathers present a credible path forward: materials that could retain the structure and lifespan of traditional leather without the environmental or ethical cost.

why other alternatives have failed

Previous attempts to introduce synthetic saddles have created a lasting stigma. Plastic-based "vegan leather" saddles exist, but they occupy the bottom tier of the market - cheap equipment for beginners. The reasons are legitimate: durability concerns (leather saddles last 20+ years and experience heavy usage in a variety of environmental conditions), performance issues (break-in characteristics, grip), and cultural resistance (in a sport with 6,000+ years of tradition, "fake leather" signaled cheapness).

My primary research confirmed this stigma persisted. Survey respondents expressed concern that alternative materials "wouldn't hold up" or "wouldn't feel the same."

strategic timing: the luxury sector as catalyst

My research identified a critical timing advantage. Luxury fashion brands were beginning to launch bio-based leather alternative products in 2021 (Hermès' mycelium bag, Stella McCartney's mushroom leather pieces), creating consumer awareness and credibility for the material category.

The equestrian market, given its close relationship with fashion, would be influenced by these launches. This meant brands entering the space wouldn't need to educate consumers about bio-leather from scratch; they could build on existing awareness while being first-to-market in equestrian applications.

the research question

The core question became: Could bio-based leather alternatives overcome the stigma that plastic-based synthetics had created? And more specifically: What type of bio-leather alternatives, positioned through which brand partnership, would equestrian consumers actually accept?

the research approach

To determine whether bio-based leather alternatives could succeed in the equestrian saddle market (and if so, how) I needed to answer questions that existing industry reports couldn't address:

What do equestrian consumers actually think about leather alternatives?

What are their specific concerns about performance and durability?

What price premium (if any) would they accept?

Which luxury saddle brands have the credibility to introduce material innovation?

What pain points exist in the current saddle purchase process that a new entrant could solve?

The research design combined secondary analysis of two distinct industries with primary consumer research to bridge the gap between market opportunity and consumer reality.

Primary Research: Testing Assumptions

I surveyed 139 equestrian consumers (targeted through equestrian Facebook groups, online forums, and riding communities) to understand:

Attitudes toward bio-leather:

Awareness of leather alternatives

Interest level in purchasing bio-leather saddles

Specific concerns about performance, durability, feel

Price expectations (willingness to pay more, same, or less than traditional leather)

Pain points in current experience:

Frustrations with the saddle buying process

Desired features or technologies that don't currently exist

Trust factors that influence brand selection

Purchase behavior:

Preferred sales channels and why

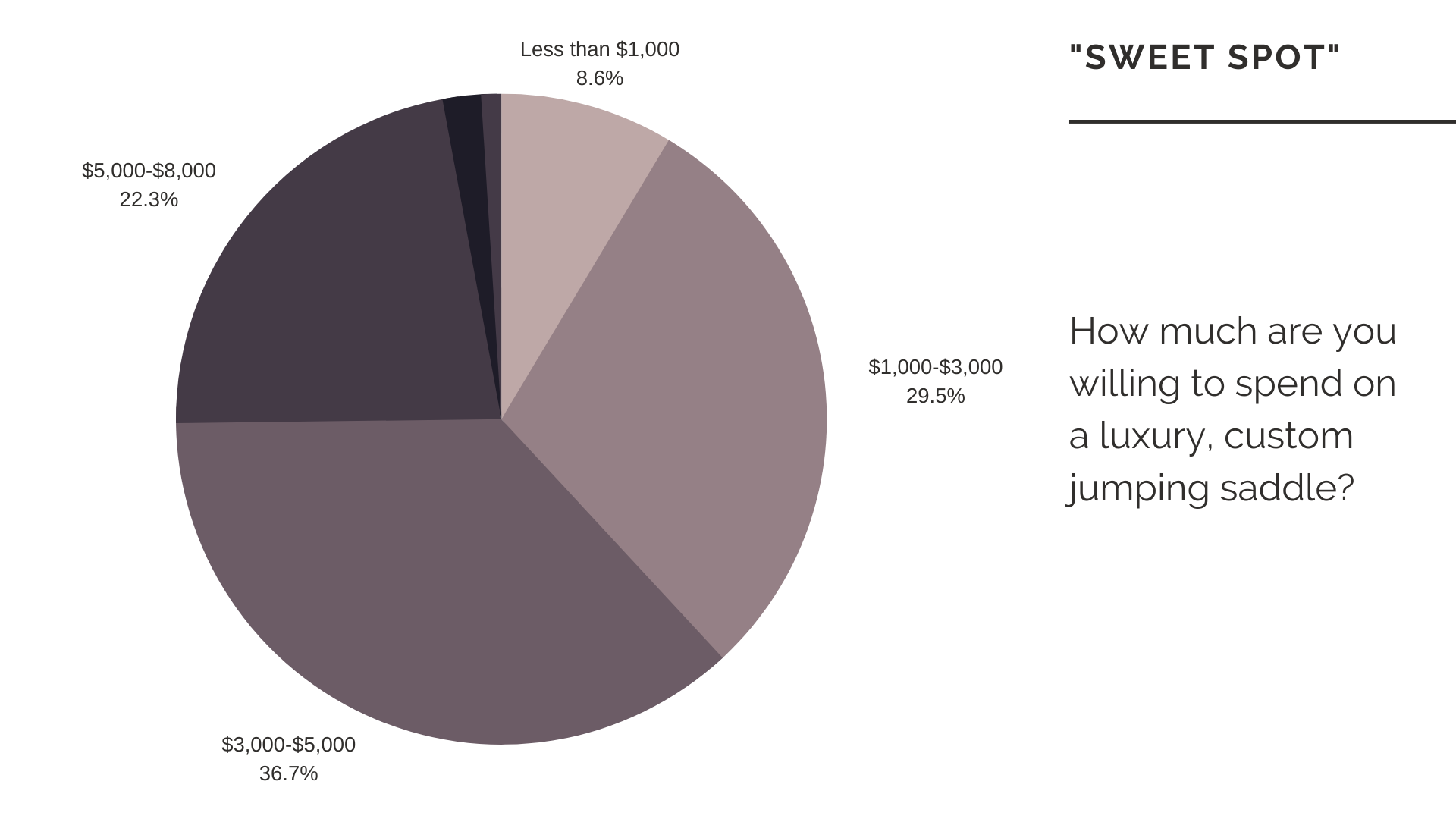

Price sensitivity and "sweet spot" for luxury saddles

Brand preferences and loyalty drivers

Decision-making process and timeline

Important Insight

While 55% of respondents expressed interest in bio-based leather alternative saddles, the qualitative responses revealed the challenge:

Interest was conditional on absolute performance parity or even improvement.

Respondents weren't willing to compromise on durability, feel, or longevity. Sustainability and ethics were nice additional purchasing information, not the reason for a purchase. This insight fundamentally shaped the strategic direction. It meant that not all bio-leather technologies would work for this application. The material would need to match or exceed traditional leather on every performance dimension, not just approximate it.

market landscape

Brand Dynamics: Prestige ranked fourth in preference among surveyed U.S. luxury saddle buyers, behind CWD, Devoucoux, and Butet. These top brands dominate through emotional loyalty and personal relationships with fitters and reps — not just product quality.

Strategic Gap: Prestige had a legacy of innovation (fiberglass trees, proprietary leathers) but lacked a current innovation story. Rivals were advancing on other fronts: Voltaire with sensor technology, Devoucoux with sustainable tanning.

White Space: None addressed cruelty-free or lab-grown materials despite over half of surveyed consumers expressing interest.

Strategic Framework: The Ripple Effect

Luxury leads, everyone else follows.

When Hermès launches a bag in mycelium, it signals to the market that the material is viable. When CWD introduces carbon fiber, competitors follow within 18 months.

By launching lab-grown leather at the top of the equestrian market first through a high-performance, high-trust partnership,Prestige could:

Establish the credibility of the material.

Lead with performance and design. Let sustainability be the proof of progress, not the reason for it.

Influence the broader tack market downstream.

It’s the same diffusion pattern seen across every major luxury innovation cycle: proof at the top, adoption at scale.

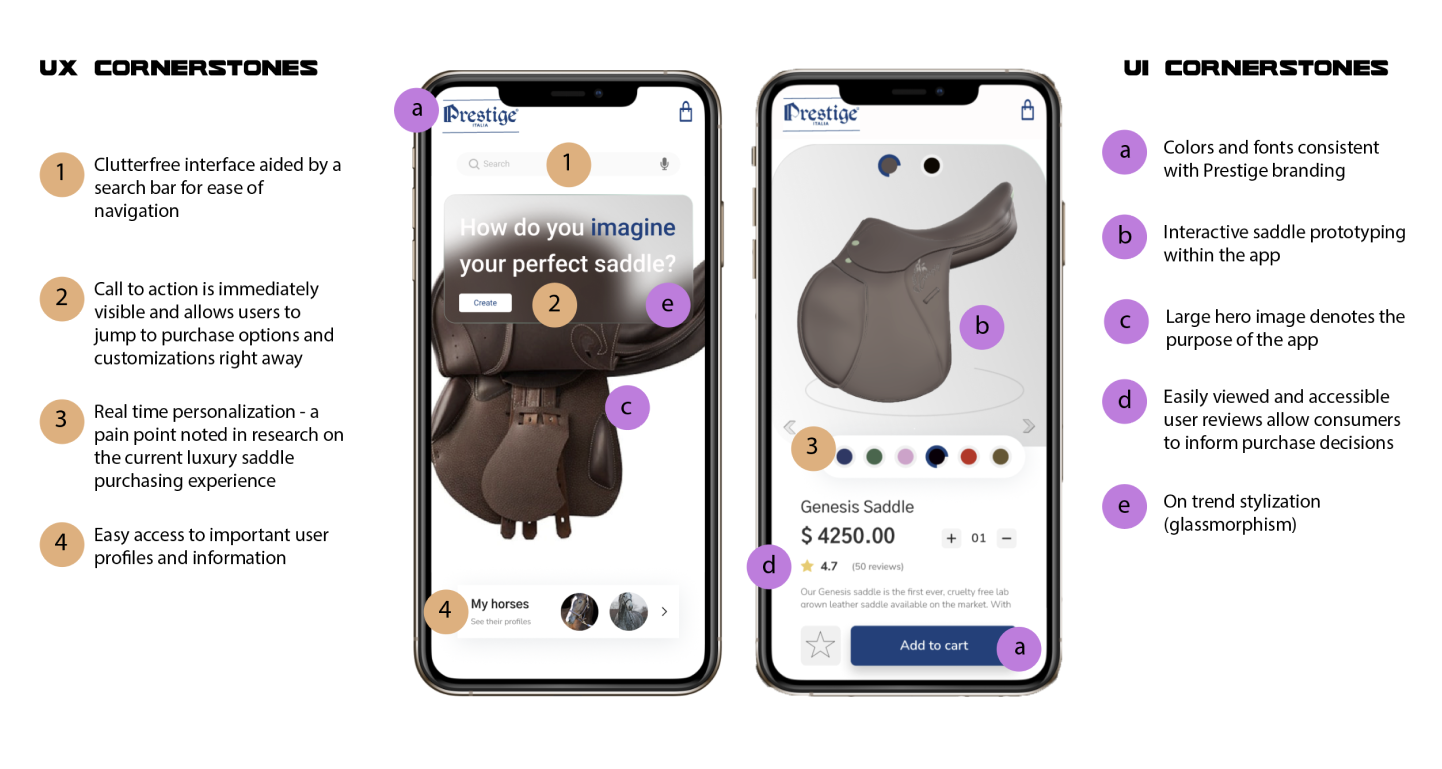

strategy and initiatives

Materials sourcing & product: Prestige will engage in a materials-sourcing deal with VitroLabs Inc. to create the first saddle made from animal cell-based, lab-grown leather. This will be a major differentiator compared to other top luxury saddle brands. To launch, Prestige will pair the product with a marketing campaign and a customization app that lets riders preview builds and stores fit data in a personal profile to support ongoing service and trust. The new saddle will be named “Genesis” to mark the start of a new era for the brand.

Targeted Rider Segmentation

Primary research showed two distinct consumer segments.

Professional riders are performance-driven with low brand loyalty. They are early adopters who switch when a product performs better.

Amateur riders are brand-loyal and influenced by professional preferences.

This launch strategy intentionally targets professionals first. Their adoption would validate Genesis publicly, creating social proof that would cascade through the amateur market.

Go-to-market (omnichannel):

The plan combined traditional equestrian sales channels with new digital tools to modernize without replacing the trusted direct-sales model.

Professional endorsements: supply Genesis prototypes to top riders for testing and public visibility.

Omnichannel activation: equip saddle-fitting representatives with iPads loaded with a customization app that previews builds, stores fit data, and connects riders directly to their rep.

Event integration: debut the product through sponsored jumps at major circuits (WEF, Devon, Global Champions Tour, HITS, and the AIG $1 Million Grand Prix) supported by a strong vendor-village and social presence.

Educational storytelling: publish transparent content showing performance validation, material testing, and long-term durability comparisons.

Phased Rollout Plan

The initiative follows a 13-month timeline:

Pre-Launch: controlled rider trials, R&D completion, teaser campaign introducing “next-generation performance materials.”

Launch: official debut at Grand Prix events, introduction of the customization app, limited Genesis release.

Scale: expansion into bridles, boots, and accessories, exploring OEM and licensing opportunities.

Pricing & Positioning

Genesis would launch at premium-parity pricing, matching Prestige’s highest-end models. Research showed equestrians equate higher price with performance, quality, and safety.

Performance Validation

Durability and feel were non-negotiable. The plan included comparative testing under multiple weather and wear conditions and long-term rider feedback to build a credible performance dataset. These results would form the foundation of marketing claims and serve as proof of parity with traditional leather.

KPIs focused on three tiers of impact:

Product performance (trials, conversions, and rider sentiment)

Digital engagement (app downloads, customization completions, and purchase attribution)

Campaign visibility (event traffic, social engagement, and earned media reach)

product concept

The Genesis Saddle

app concept

reflection & future direction

This project reshaped the way I think about sustainability and innovation. Through the research, I realized that introducing a new material isn’t just a manufacturing challenge, it’s a communication one. The success of any bio-based or lab-grown material depends on how effectively it can be framed within the values consumers already hold: quality, performance, and trust.

My work on this thesis taught me that the path to adoption isn’t through guilt or disruption, but through alignment. Brands need to show that innovation can strengthen, not threaten, the legacy of craft. Prestige’s challenge mirrored a broader truth in next-generation materials: the most radical ideas succeed when they feel inevitable.